Q. I want to invest and get a green card, is the EB-5 Visa right for me and my family?

A. An EB5 investor Visa is suitable for people from all walks of life: professionals, business people, persons wanting to facilitate their children’s education and to attend US Universities, persons just seeking a new or better life in the United States, and persons wanting to retire in the United States. Quite simply, the EB-5 visa gives you the opportunity and flexibility to do what you want in the USA. If you don’t want to actively manage your business, you should consider a Regional Center EB-5 Investment.

Q. Where can I obtain a copy of EB-5 law and regulations?

A. You may find a link to information concerning EB-5 law and regulations at the USCIS Government website.

Q. How many EB-5 visas are allotted for this classification each year?

A. The EB-5 program allocates 10,000 visas per year for aliens and family members whose qualifying investments result in the creation or preservation of at least ten (10) full-time jobs for U.S. workers. At least 3,000 of these immigrant visas are set-aside for aliens who invest in designated regional centers, areas of high unemployment or other qualifying rural areas. Approximately 90% to 95% of all EB-5 investments are made through Regional Centers.

Q. What is the EB-5 Investment Visa Program all About?

A. The Investment Visa Program takes advantage of the immigrant visa category for alien entrepreneurs known as the EB-5 Immigrant Investor Visa, created by the Immigration Act of 1990. In general terms, the EB-5 program requires an alien to “invest or be actively in the process of investing,” either US$1,000,000 or US$500,000, which is “at risk” in a “new or existing business enterprise” that directly or indirectly results in the creation or preservation of ten full time (at least 35 hours per week) jobs for a two year period. A successful applicant can earn permanent residency for him or herself, a spouse and the children under age 21.

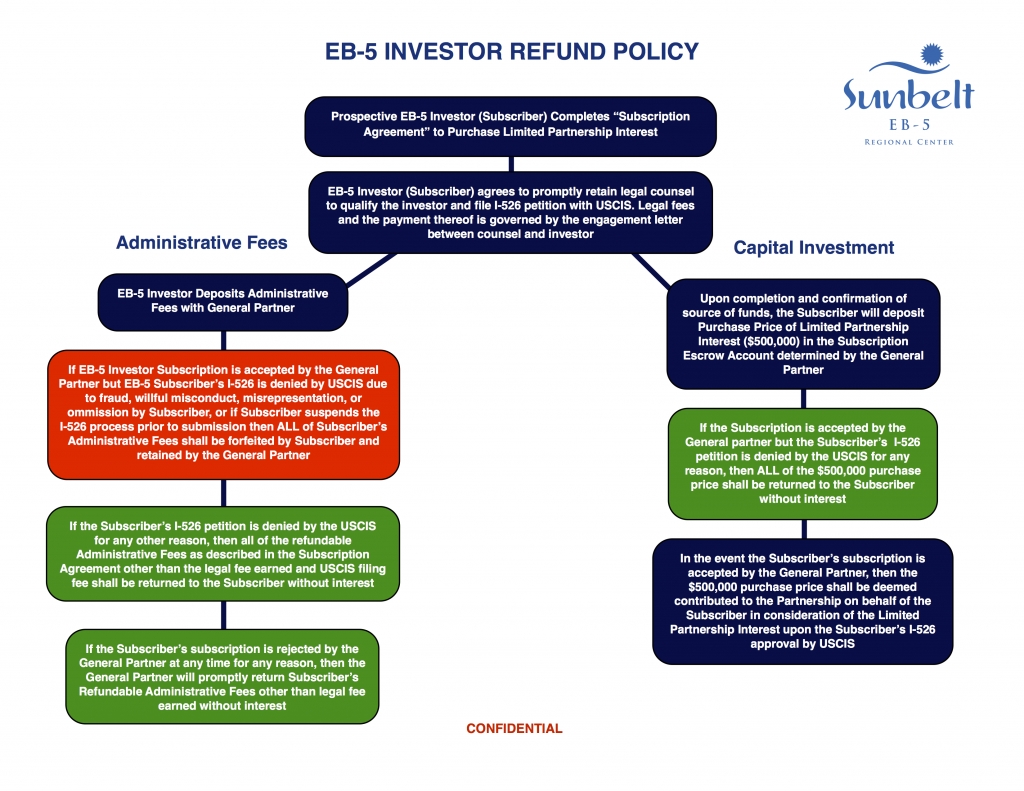

Q. If my I-526 petition is Denied, will I Receive my Funds Back?

A. Yes. The full capital investment amount of US$500,000 will be returned to the account from which the funds originated. See the Investor Refund Policy for more details.

Q. How long must I Remain in the United States Each Year?

A. The first requirement of any investor after they receive the visa at the United States overseas consulate office is to enter into the United States within 180 days of visa issuance from the consulate. The investor must then establish residency in the United States. Evidence of intent to reside includes opening bank accounts, obtaining a driver’s license or social security number, paying state and federal income taxes, renting or buying a home. The United States resident may work overseas if required based upon the nature of the business or profession. For those permanent residents living outside the U.S., we suggest the investor and family re-enter the U.S. no less than once every six months. The longer the investor and family are present in the U.S., the less likely the government is to claim that the investor “abandoned” the United States as a permanent residence – thereby endangering his green card status. In some cases, investors may seek the issuance of a “reentry permit” which allows the Investor permission to remain outside the U.S. for as long as two years without having to reenter the country to maintain permanent resident status.

Q. After the I-526 petition Approval, Can Members of the Family have their Consulate Interview in Different Countries (i.e. children attending school in the United States and the parents in China, etc.)?

A. Family members can interview in different countries. The country of origin or where the family has current ties is the standard interview site. Often one member of the family is located in another country, such as a student attending school in the U.S. The student does not have to return to the country of origin and can adjust status in the United States at the district office of the USCIS.

Q. If my I-526 petition is Approved by USCIS, What is the Purpose of the Consulate Application and Interview?

A. The purpose of this application is to ensure that the investor and his or her family undergo medical, police, security and immigration history checks before the conditional permanent resident visas are issued. At the interview, the consulate officer may address these issues and information printed on the I-526 petition, including asking the investor to summarize the nature of his or her immigrant investment. If the investor and his or her family are in the United States, they may apply to adjust their status at the appropriate office of the USCIS.

Q. Do all Family Members get Conditional Permanent Residence Status at the Same Time?

A. The investor, his or her spouse and any unmarried, under 21 year old children can obtain permanent residence at the same time and through a single investment of the mother or father.

Q. If the EB-5 investor Decides to Invest in One of Sunbelt’s EB-5 Regional Centers Projects, How do They Submit their Investment Funds to Sunbelt?

A. In the Sunbelt’s specific project offering documents, our Center provides a copy of an escrow agreement and the wire transfer instructions to the escrow bank account. Within 48 hours of your wire transfer, our office will receive a remittance confirmation for your records. A copy of the remittance confirmation is provided to you and is included as part of your I-526 petition.

Q. How is the EB-5 investor’s Limited Partnership Interest Protected?

A. The USCIS requires that some financial risk be involved so the Regional Center cannot guarantee the return, but the Center will make all best efforts to minimize the amount of risk by making sure that the investment is properly collateralized and that the partnership is in strong financial standing. Our Regional Center will recommend investment opportunities to a partnership only after an extensive financial and project review. All limited partners will receive periodic reports with financial and partnership information. A limited partner can contact the General Partner (a Sunbelt affiliate) to request any partnership information.

Q. What Role does a Limited Partner Play in the LP Arrangement?

A. The EB-5 regulations require involvement in management or policy making. The regulations deem a limited partner in a limited partnership, which is properly structured and that conforms to the Uniform Limited Partnership Act as sufficiently engaged in the EB-5 enterprise.

Q. In the Sunbelt EB-5 Regional Center the Investment Structure deployed is a Limited Partnership (LP). What is a Limited Partnership?

A. A limited partnership is a business organization with one or more general partners, who manage the business and assume legal debts and obligations, and one or more limited partners, who are liable only to the extent of their investments. Limited partners also enjoy rights to the partnership’s cash flow, but are not liable for company obligations.

Q. When Must the Employment be Created?

A. The EB-5 petition must document that the required 10 jobs will be created within a 2 1/2 year period immediately following the approval of the EB-5 petition.

Q. Must the EB-5 investment Result in the Creation of Employment for U.S. Workers?

A. Each EB-5 investor’s capital investment of US$500,00 or US$1,000,000 must create full-time employment for at least 10 U.S. citizens or immigrants(permanent resident aliens and other specified immigrant categories). The required 10 positions cannot include the investor or the investor’s spouse or children. The 10 jobs must be for employees of the enterprise in which the investment is made and cannot include independent contractors. However, for USCIS designated Regional Centers, the creation of employment can include indirect and induced employment.

Q. What is Meant by the Requirement that the Investor’s Assets be Lawfully Gained?

A. Under USCIS regulations, the investor must demonstrate that their assets were gained in a lawful manner. This requires the investor to prove their investment funds were obtained through lawful business, salary, investments, property sales, inheritance, gift, loan, or other lawful means. The Regional Center requires an investor to reveal where and how they received their assets in the amount of at least US $500,000 that are used for qualifying for the program capital investment. This may be accomplished through certificates by the investor’s licensed accountants, lawyers, court records, salary statements, tax statements, real estate documents and the like. Generally, the investor will present some combination of individual and/or business tax returns, employment records, documentation regarding sale of or dividends from a business, documentation regarding gifts or inheritance, and documentation regarding securities or real estate transactions.

Q. If I Choose to Invest in a Regional Center Project, Must I be an Accredited Investor to Apply?

A. An accredited investor is a term defined by various security laws that describes investors permitted to invest in certain types of higher risk investments including limited partnerships, hedge funds and other investor networks. In the U.S. an individual is considered to be an accredited investor if he or she has a net worth of at least $1 million US dollars (excluding their primary residence) or has made at least $200,000 US dollars each year for the last two years ($300,000 with spouse if married) and has the expectation to make the same amount in the current year. The EB-5 capital investment of $500,000US dollars that will be used for the investment can be counted towards the requirement of $1 million US dollars in assets.

Q. What is the Minimum Amount of Investment Required?

A. For investments in areas other than “targeted employment areas (TEA’s),” the minimum amount of investment is $1 million. Investments in “targeted employment areas,” including many approved regional centers, can qualify with a minimum of $500,000.

Q. What is a Targeted Employment Area (TEA)?

A. A targeted employment area is a rural area or a geographical area that has experienced unemployment at a rate of at least 150% of the national average rate. Individual states are authorized to designate geographical areas within the state that qualify as targeted employment areas.

Q. What is the Procedure for an EB-5 investor to Qualify as an Immigrant Based upon such Investment?

A. Form I-526, “Immigrant Petition by Alien Entrepreneur,” must be filed with the USCIS. The petition must be supported by a substantial amount of documentation proving that the investor meets all of the requirements. Once the petition is approved, the investor may either apply for an immigrant visa at a U.S. Consul or, if the investor is in the United States, apply for adjustment of status to permanent residence.

Q. How many EB-5 visas are allotted for this classification each year?

A. The EB-5 program allocates 10,000 visas per year for aliens and family members whose qualifying investments result in the creation or preservation of at least ten (10) full-time jobs for U.S. workers. At least 3,000 of these immigrant visas are set-aside for aliens who invest in designated regional centers, areas of high unemployment or other qualifying rural areas. Approximately 90% to 95% of all EB-5 investments are made through Regional Centers.

Q. What is the Timing of the I-526 Petition Process?

A. The I-526 petition is generally reviewed within eight to ten months. The conditional permanent residence process generally takes between four and nine months depending upon whether the investor is in the U.S. or, if outside of the U.S., which consulate will be interviewing the investor.

Q. Where Can I Obtain a Copy of EB-5 Law and Regulations?

A. You may find a link to information concerning EB-5 law and regulations at www.uscis.gov. (Click on the LAWS tab)

Q. I Want to Invest and Get a Green Card, is the EB-5 Visa Right for Me and My Family?

A. An EB5 investor Visa is suitable for people from all walks of life: professionals, business people, persons wanting to facilitate their children’s education and to attend US Universities, persons just seeking a new or better life in the United States, and persons wanting to retire in the United States. Quite simply, the EB-5 visa gives you the opportunity and flexibility to do what you want in the USA. If you don’t want to actively manage your business, you should consider a Regional Center EB-5 Investment.

Q. What Documents Must be Filed with the I-526 Petition?

A. Specifically, documentation must prove the actual transfer or commitment of the EB-5 investor funds; the lawful source of the investor’s funds; the location of the investment in a targeted employment area (if the investment is less than $1 million); the investment in a new commercial enterprise; the involvement of the investor in the business; and the actual creation of 10 full-time positions or a comprehensive business plan showing the need for the 10 employees and the approximate dates when they will be hired. Specific additional documents will be required depending upon the details of the investor and the investment being made.

Q. What type of businesses should the EB-5 investment be made?

A. The investment must be in a “new commercial enterprise” in the United States. “New” means that the investment must have been made after November 29, 1990. “Commercial” is to be distinguished from a passive, speculative investment, such as a purchase of real estate for use as a personal residence or for potential appreciation in value (as opposed to an active real estate development project). The U.S. investment can be in any one of four forms: (1) the creation of a new business; (2) the purchase of an existing business, which is reorganized to form a new enterprise; (3) the expansion of an existing business; or (4) the saving of a failing business.

Q. Will an Attorney Advise Me on Whether an Investment will Provide a Good Financial Return?

A. No. The attorney will only advise on visa matters. The EB-5 investor will need to conduct their own due diligence and make there own economic decision.

Q. What Must be Proven in Order to Obtain Removal of Conditions on Permanent Residence?

A. The investor must prove that the investment has been sustained – not withdrawn – and that the requisite jobs have been created as set forth in the business plan filed with the EB-5 petition.

Q. Is the Immigration Status Granted to the Investor Valid Indefinitely?

A. The permanent resident status granted to the investor is actually a “conditional permanent resident status” that is valid for a period of up to two years. The investor and family members are required to remove the condition by filing an application during the 90 day period preceding the second anniversary of obtaining this status. The petition will be required to demonstrate the establishment of the business, the investment of the requisite amount of capital and the creation of the required number of jobs.

Q. Is an EB-5 investment in a Regional Center Guaranteed?

A. No. There is both an immigration risk and a financial risk. Regional centers may have a number of different projects. It is possible for a regional center to obtain pre-approval of a specific project. Even if a project is pre-approved, there is an immigration risk as to whether the necessary jobs will be created in order to obtain removal of conditions. There is also financial risk in every investment. For these reasons, it is critical for the investor to choose both the regional center and the regional center project very carefully.